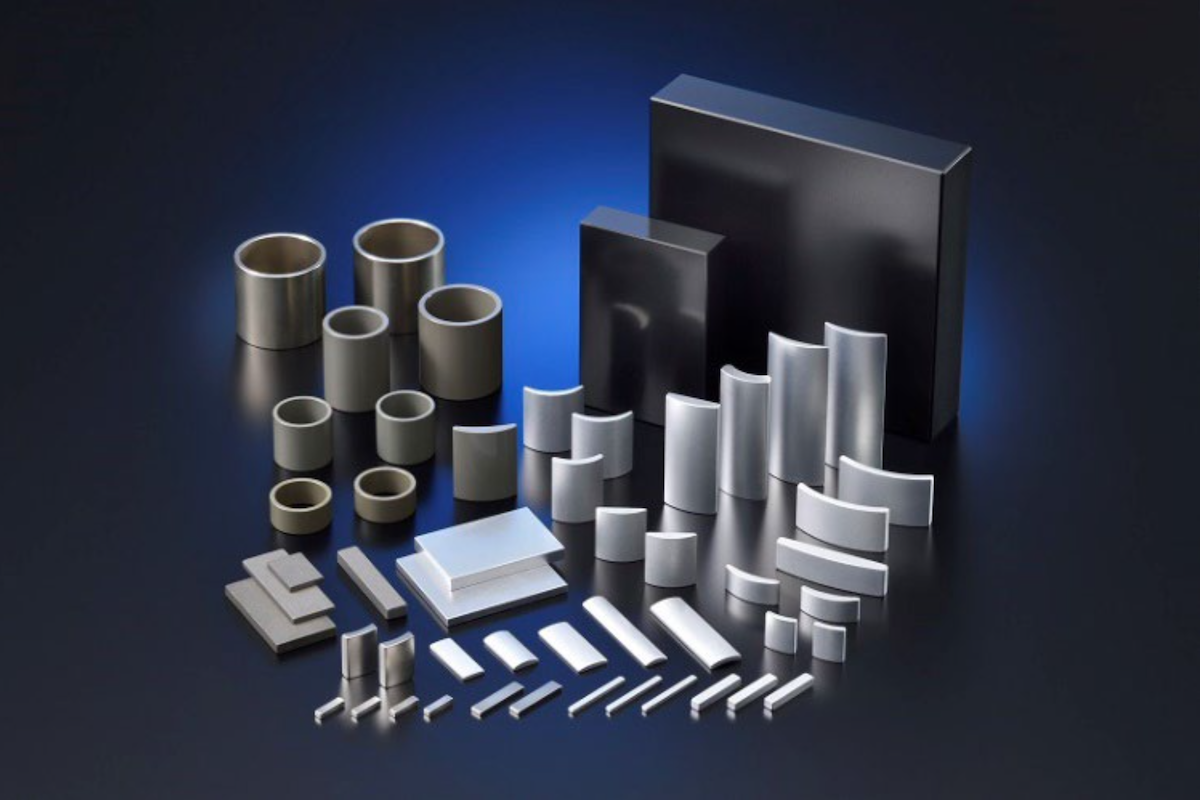

According to reporting by Nikkei citing data from British research firm Argus Media, prices in the European market for dysprosium—an essential material for permanent-magnet motors used in electric vehicles—have surged to USD 960 per kilogram (approximately NT$30,275), while terbium prices have climbed as high as USD 4,000 per kilogram (approximately NT$126,146). These two rare-earth elements have set new highs for two consecutive weeks, based on data going back to 2015, indicating a rapid deterioration in supply-demand conditions. As dysprosium and terbium significantly enhance magnet stability in high-temperature environments, they are virtually irreplaceable for high-power EV motors, meaning price fluctuations will be directly reflected in vehicle costs and margin structures.

Beyond automotive applications, other key rare-earth metals have also risen in tandem, further intensifying competition across industries. Yttrium, a superconducting material widely used in medical devices and LED components, has jumped from USD 260 per kilogram (approximately NT$8,200) at the end of last year to USD 425 (approximately NT$13,403). Meanwhile, gallium—a critical strategic metal heavily used in defense equipment such as radars and missile guidance systems—has reached USD 1,600 per kilogram (approximately NT$50,458), marking a new high since the beginning of the year.

One of the key triggers behind this price surge was mainland China’s announcement earlier this year that it would strengthen export controls on dual-use items bound for Japan. This move is widely interpreted as being linked to comments made by Japanese Prime Minister Sanae Takaichi in November regarding a potential Taiwan Strait crisis, and is seen as carrying strong political signaling. Given mainland China’s dominant position in global rare-earth supply, any tightening of policy is quickly translated into price volatility in international markets.

It is worth noting that after trade negotiations with the United States, mainland China postponed the implementation of rare-earth export restrictions last autumn, allowing related prices to stabilize temporarily toward the end of 2025. However, as policy toward Japan has turned more hardline, market expectations have shifted once again. Some companies have already begun accelerating stockpiling efforts to hedge against potential supply disruptions, further pushing up short-term prices.

The continued rise in global defense spending has also become a key structural factor driving the rare-earth market. Maeve Flaherty, senior rare-earths reporter at Argus Media, noted that demand for yttrium in the defense and electronics sectors has increased markedly, and under tight supply conditions, prices are naturally facing upward pressure.

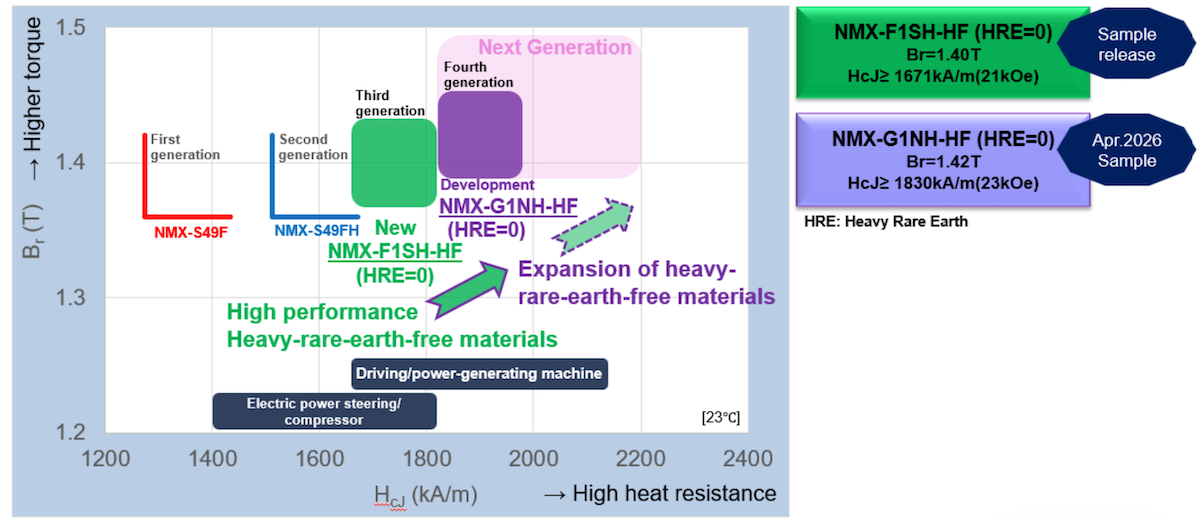

From a strategic industry perspective, this new wave of rare-earth price highs represents more than just a cost issue for EV manufacturers; it is a test of supply-chain resilience and geopolitical risk management. Yoshikiyo Shimamine, senior fellow at the Dai-ichi Life Research Institute, warned that rare-earth prices are likely to remain highly volatile at elevated levels in the near term, forcing companies to reassess long-term procurement contracts, diversify sourcing, and even accelerate the development of rare-earth-free or low–rare-earth magnetic technologies.

Overall, as the electric vehicle industry has yet to fully emerge from the shadows of price competition and slowing demand, turbulence in the rare-earth market adds another layer of uncertainty. Going forward, rare earths will no longer be merely a materials engineering issue, but a strategic resource deeply intertwined with industrial competitiveness, national security, and international politics—making risk management capabilities a critical dividing line for the automotive industry’s next phase of development.