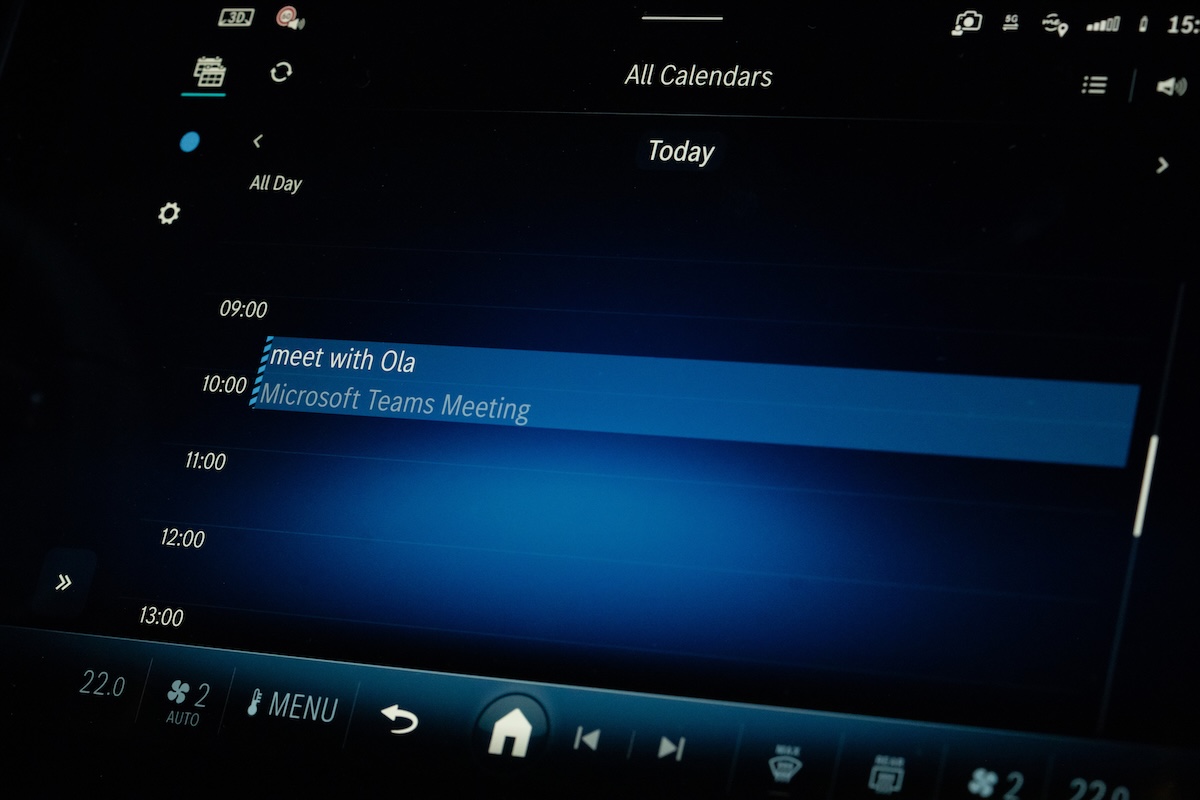

First and foremost, a fundamental shift in the automotive value structure has become the key driver behind this strategic reconsideration. For modern vehicles, the customer experience is no longer determined solely by power delivery or driving refinement, but is instead shaped collectively by infotainment systems, driver-assistance functions, connected services, over-the-air (OTA) updates, and broader digital ecosystems. Software is rapidly becoming the core source of vehicle differentiation and long-term revenue, accounting for a growing share of total vehicle value and simultaneously increasing both the complexity and strategic importance of software development.

However, for most traditional European automakers, the practical difficulty of developing comprehensive in-house software has proven far greater than initially anticipated. Automotive engineering culture has long been hardware-centric, with organizational structures, development processes, and talent pipelines not designed for large-scale software platforms. As vehicle systems are required to integrate operating systems, middleware, cloud services, and cybersecurity architectures, internal development efforts often encounter delays, cost overruns, and fragmented system architectures—ultimately slowing down vehicle launch cycles rather than accelerating them.

Competitive pressure from external markets has further amplified these structural weaknesses. Chinese electric vehicle brands and U.S. technology-oriented automakers generally adopt a “platform-first” strategy in software and digital services, enabling faster product iteration and more comprehensive user data feedback loops. By contrast, European automakers that persist with a go-it-alone approach often struggle to keep pace in areas such as artificial intelligence, user interfaces, and in-vehicle ecosystems, with the risk that the gap continues to widen over time.

Cost and efficiency considerations are equally difficult to ignore. Within multi-brand, multi-model group structures, individual brands developing their own proprietary software stacks leads to extensive duplication of investment and inefficient use of R&D resources. As software development expenditure rises rapidly, European automakers are increasingly recognizing that not every software layer delivers meaningful differentiation. Sharing foundational systems can instead help concentrate resources on application and service layers that truly influence brand competitiveness.

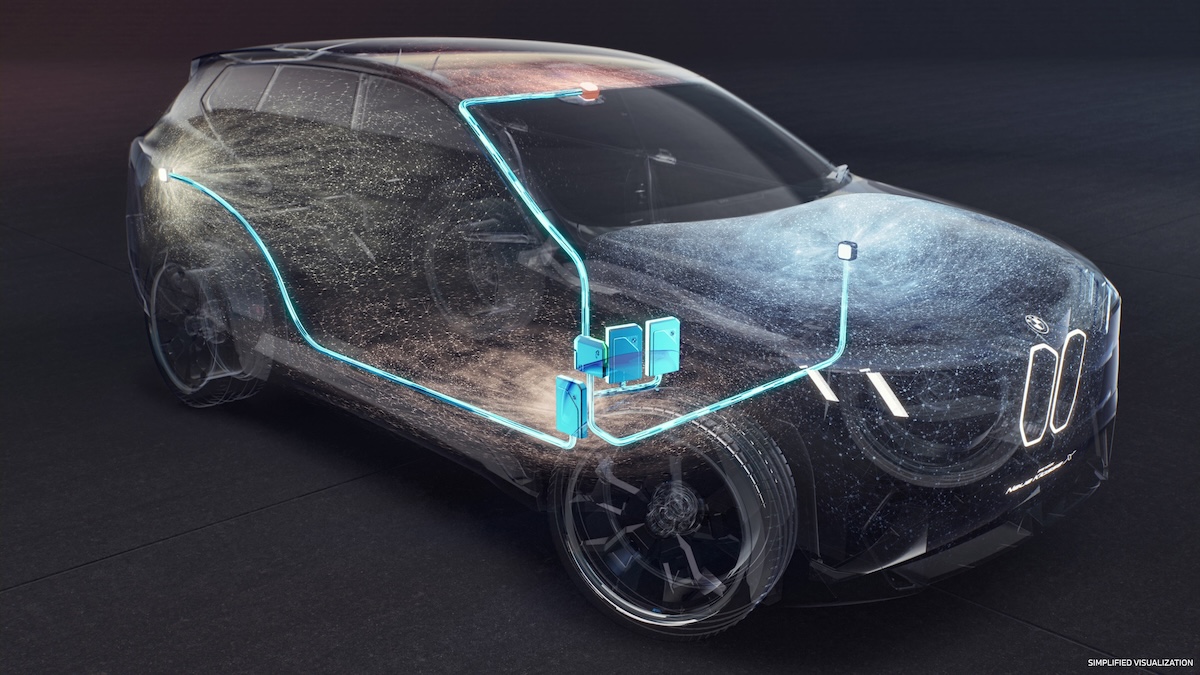

Against this backdrop, openness and collaboration have emerged as pragmatic alternatives. Major European automakers and suppliers—including Volkswagen, BMW, Mercedes-Benz, and Bosch—have in recent years actively promoted shared, open-source automotive software platforms, aiming to establish common standards across operating systems, middleware, and development tools. This approach does not represent a surrender of autonomy, but rather a redefinition of the boundary between what must be controlled in-house and what can be built collectively, thereby lowering technical barriers and development risks.

In addition, the rapid evolution of the regulatory environment has accelerated this strategic shift. New UNECE regulations governing software updates and cybersecurity have significantly increased compliance and validation costs for vehicle software. For individual automakers, maintaining a fully independent compliance framework is becoming an increasingly heavy burden, while standardized platforms and shared toolchains are better suited to ensuring consistency and long-term maintainability.

Overall, Europe’s reconsideration of software independence is not a strategic retreat, but a realistic adjustment to new industry conditions. In an era where software has become a core element of automotive competitiveness, fully proprietary development is no longer automatically synonymous with competitive advantage. Through open collaboration, shared foundations, and a sharper focus on differentiation, the European automotive industry is seeking to preserve its engineering strengths while regaining momentum in the digital age.