The mechanism is expected to involve around 20 semiconductor suppliers, including key automotive chipmakers such as Japan’s Renesas Electronics and Rohm, as well as Germany’s Infineon Technologies. Notably, the system does not include semiconductor manufacturers from mainland China. Even so, it is projected to cover approximately 80% to 90% of the automotive semiconductor demand of Japanese automakers, underscoring its high degree of representativeness and practical influence.

Under the plan, participating chip manufacturers will register core information such as product specifications, mass production start dates, and manufacturing origins. This will enable automakers to more quickly identify components with unstable supply sources or latent risks. To prevent data leaks or improper use by competitors, the system will be managed using blockchain technology, striking a balance between information transparency and the protection of commercial confidentiality.

The initiative is jointly led by the Japan Automobile Manufacturers Association (JAMA) and the Japan Auto Parts Industries Association, with participants including major vehicle manufacturers such as Toyota and Honda. The database is targeted for completion by April this year, with ongoing operations expected to be handled by the Tokyo-based Automotive and Battery Traceability Center. This move also highlights Japan’s attempt to address long-standing structural issues arising from fragmented information across the automotive supply chain through an organized, platform-based approach.

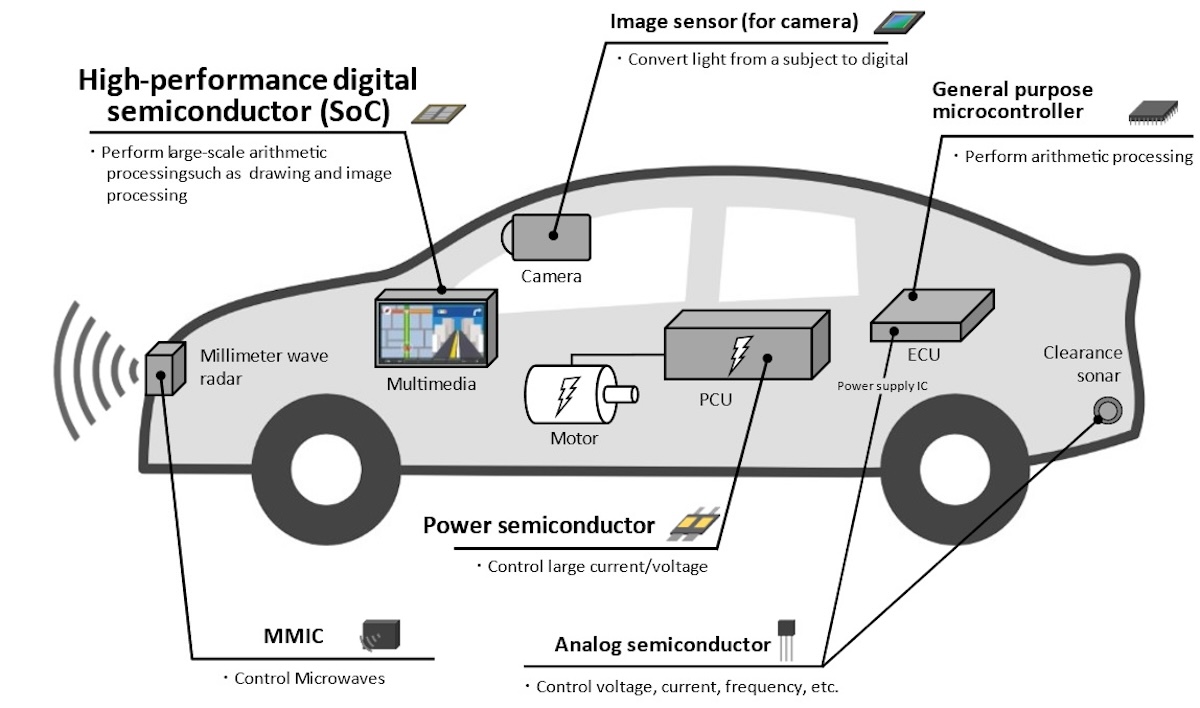

The strategic importance of automotive semiconductors now extends far beyond navigation systems or infotainment devices, encompassing critical functions such as powertrain control, battery management, and safety systems. The global chip shortage triggered during the COVID-19 pandemic forced many automakers to significantly cut production, underscoring how deeply semiconductor supply affects the entire manufacturing ecosystem. Even as supply and demand gradually stabilize in the post-pandemic period, geopolitical conflicts and supply concentration risks continue to pose persistent threats.

In the case of Japanese automakers, last year’s suspension of shipments by the Chinese-owned semiconductor supplier Nexperia directly forced Honda and Nissan to adjust production line configurations and output plans. Honda has further estimated that semiconductor supply issues will reduce its operating profit by approximately 150 billion yen (around NT$30.22 billion) for the fiscal year ending March 2026, highlighting the tangible financial impact of semiconductor-related risks on corporate performance.

For many years, the automotive industry has exhibited a highly tiered, pyramid-like structure, with vehicle manufacturers at the top and multiple layers of Tier 1, Tier 2, and Tier 3 suppliers beneath them. Due to the complexity of this division of labor, automakers have often struggled to fully grasp the sources of raw materials and components further down the supply chain, limiting their ability to conduct comprehensive risk assessments and respond swiftly. The establishment of this semiconductor information-sharing system is intended precisely to address this structural blind spot of an incomplete overall view.

With more comprehensive information on chip sources and specifications, automakers are expected to be better positioned to quickly assess the scope of impact when faced with sudden geopolitical events or natural disasters, and to activate alternative solutions or adjust designs at an earlier stage to reduce the risk of production stoppages. The system will also be open to non-Japanese automakers upon application, indicating that its potential influence is not confined to Japan’s domestic market.

As the automotive industry rapidly advances toward autonomous driving and artificial intelligence applications, the importance of semiconductors will only continue to rise. According to a forecast released by the Japan Electronics and Information Technology Industries Association in 2024, the global automotive semiconductor market is expected to reach approximately US$159.4 billion (around NT$5 trillion) by 2035, representing growth of more than 80% compared with 2025. Against this backdrop, the latest moves by Japanese automakers are not merely a response to short-term supply risks, but also a preparatory effort in terms of systems and infrastructure for the next phase of competition in the smart vehicle era.