Xpeng’s current models already feature systems that provide driving assistance on both highways and city roads, but VLA 2.0 represents a major leap forward in AI decision-making capability. According to the company, the system’s artificial intelligence has been trained on nearly 100 million real-world driving videos—equivalent to around 65,000 years of human driving experience. This enables VLA 2.0 to autonomously handle highly complex urban scenarios, such as navigating narrow alleys, bypassing temporary obstacles, or detouring through construction zones. Xpeng’s Chairman and CEO, He Xiaopeng, noted that VLA 2.0 can even interpret human gestures—for example, if a construction worker signals the car to stop, the vehicle will immediately brake and then resume driving once it receives a hand signal to proceed.

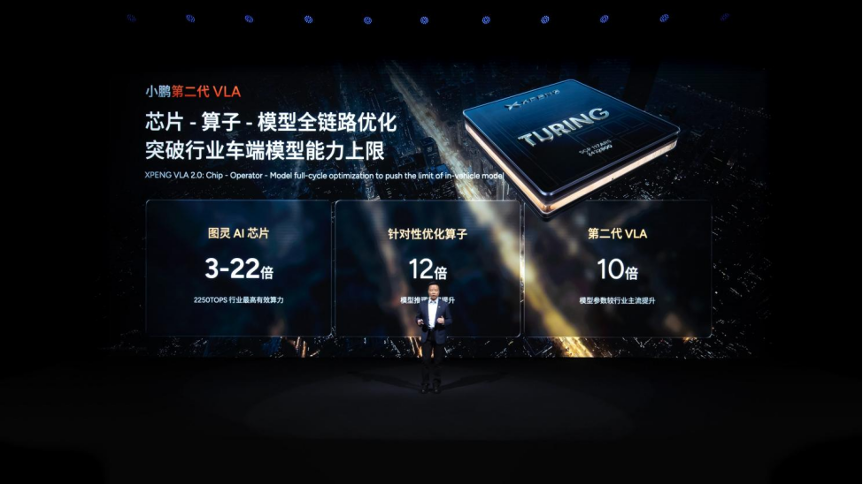

In terms of hardware, Xpeng continues to rely on a combination of cameras and sensors for external perception, but the core advancement lies in its newly self-developed “Turing” chip. The new processor reportedly delivers three times the computing power of Nvidia’s current Orin chip and will serve as the technological backbone of VLA 2.0. This move underscores the determination of Chinese automakers to achieve semiconductor independence rather than depending entirely on global supply chains. However, if Xpeng aims to enter the U.S. market, it will still face regulatory challenges, as American laws prohibit the use of China-made chips in vehicles operating on public roads.

As for international collaboration, Volkswagen will be the first automaker to adopt VLA 2.0, and the two companies will co-develop intelligent driving solutions. It remains to be seen whether Volkswagen will limit deployment to the Chinese market or eventually bring the technology to global markets. Should Volkswagen ultimately adopt Xpeng’s in-house chip, it would mark a milestone for the export of Chinese autonomous driving technology to Europe.

Currently, Tesla also offers its FSD service in mainland China, but the version available there lags behind the one offered in the United States. Due to incomplete regulatory approval from Chinese authorities, Tesla can only provide an older software version (13.2.9), whereas the U.S. has already advanced to version 14.0. According to Xpeng, early testing has shown that VLA 2.0 requires five times fewer driver interventions than Tesla’s FSD (China version), indicating significant improvements in stability and decision-making under real-world conditions.

At present, Xpeng’s semi-autonomous driving features already allow vehicles to operate independently on highways and city streets, as well as perform advanced functions such as automated parking maneuvers. Even so, VLA 2.0 still requires drivers to remain alert and ready to take control at any moment—similar to Tesla’s FSD standards. Notably, while Tesla’s FSD in the U.S. costs about NT$248,000 (roughly US$8,000), Xpeng offers its driver-assistance technology at no extra cost. This strategy not only increases customer acceptance but also exerts pricing pressure on competitors.

The launch of Xpeng’s VLA 2.0 is more than just a technological upgrade—it symbolizes a critical turning point for Chinese EV brands as they move from catching up to exporting innovation in the autonomous driving field. Through its self-developed chips, large-scale AI training data, and open collaboration strategy, Xpeng demonstrates the growing integration of artificial intelligence and automotive semiconductors in China’s industry. With Volkswagen joining forces, traditional automakers may soon gain access to what could be described as a “China-powered autonomous solution.”

Nevertheless, regulatory and geopolitical barriers remain. To succeed in Europe and the United States, Xpeng will have to overcome both legal and trust-related hurdles. In summary, VLA 2.0 represents not only a direct challenge to Tesla but also a potential starting point for Chinese smart driving technology to take the global stage.