Although Waymo has been granted the operating license, the company emphasized that it will not expand immediately. Instead, it plans to move forward in a “measured, phased” manner. This cautious approach underscores Waymo’s commitment to safety and technological maturity, contrasting with more aggressive expansion strategies. This is particularly relevant following a major incident involving GM Cruise’s robotaxi in San Francisco in 2023, which led regulatory agencies to tighten oversight of self-driving technologies.

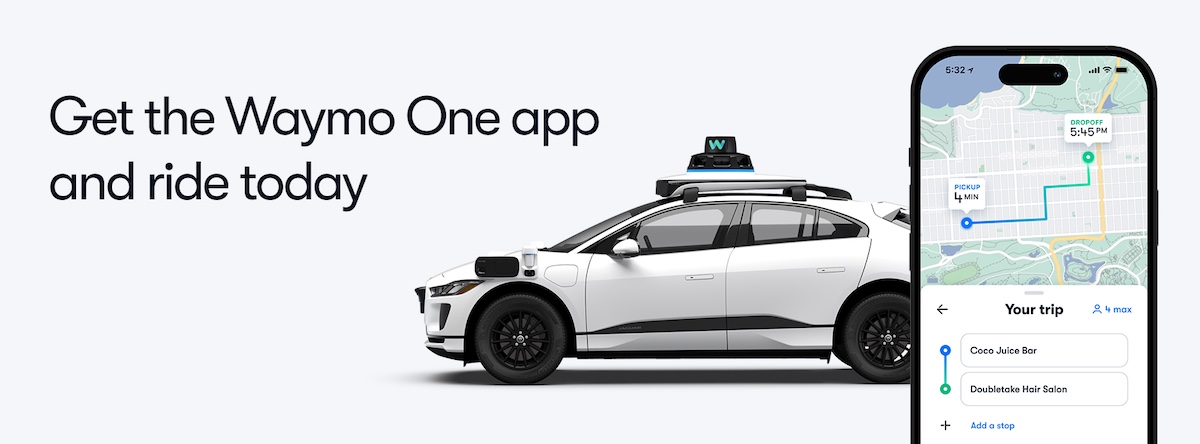

Currently, Waymo remains the only company in the United States operating a commercial, fully autonomous ride-hailing service. With a fleet of over 1,500 vehicles operating in San Francisco, Los Angeles, Phoenix, and Austin, Waymo completes more than 250,000 rides per week. Such scale has given the company a notable lead in the U.S. autonomous mobility market, providing a strong foundation for dialogue with regulators and helping to shape industry standards.

Nonetheless, Waymo is not without challenges. To address the risks posed by roadway obstacles such as chains, gates, and temporary construction barriers, the company is proactively recalling over 1,200 vehicles for a software update. This move demonstrates Waymo’s commitment to risk management and its willingness to address issues before they escalate—efforts that are crucial to maintaining public trust in autonomous ride services.

While Waymo cautiously scales up its operations, another major player in autonomous technology—Tesla—is preparing to enter the ring. CEO Elon Musk recently announced that Tesla will launch a paid robotaxi service in Austin, Texas, next month, with plans to expand to California later this year. Unlike Waymo’s approach, which relies on detailed maps and controlled testing environments, Tesla’s robotaxi service will depend entirely on its Full Self-Driving (FSD) system, a vision-based and AI-driven technology. These differing technological philosophies and go-to-market strategies will inevitably lead to direct competition as both companies target overlapping urban markets.

Overall, the expansion of Waymo and the impending entry of Tesla signal the official arrival of a two-horse race in the U.S. robotaxi market. Whether through safety-first, gradual expansion or bold, technology-led deployment, the era of autonomous taxis is no longer confined to technical validation—it has entered the critical phase of real-world service and commercial operation. The outcome of this robotaxi competition will shape the transportation landscape and mobility patterns for the next decade, with profound implications for the automotive industry and the future of smart mobility.