The frequency of talking about this question with my friends and colleagues in the past two years has become higher and higher, and major consulting companies and research institutes around the globe also keep conducting large-scale market survey about the future of automotive industry and the attitude of consumers on BEVs. The annual sale of BEVs around the world reached the record-high 4.7 million units last year (of course will renew record-high in every upcoming year). Even the impact on global car market keeps coming from the chip shortage, city lockdown due to the pandemic, the supply of raw material affected by war and unrest, etc., starting early this year, but BEVs is still a hot-selling segment, which has 1.78 million units sold in the first 4 months around the globe, and it’s increased by 70% more YOY. To view from this booming trend, please allow me to predict conservatively that the global sales of BEVs will be close to or even more than 6.5 million units this year, which means the YOY growth rate is about 40%. This figure is equal to surpassing 10% of market share, at the moment of universal pessimistic forecast on the global market performance this year; that means there is at least one BEV among every 10 newly registered cars, which will become the first milestone before the era of BEVs officially comes.

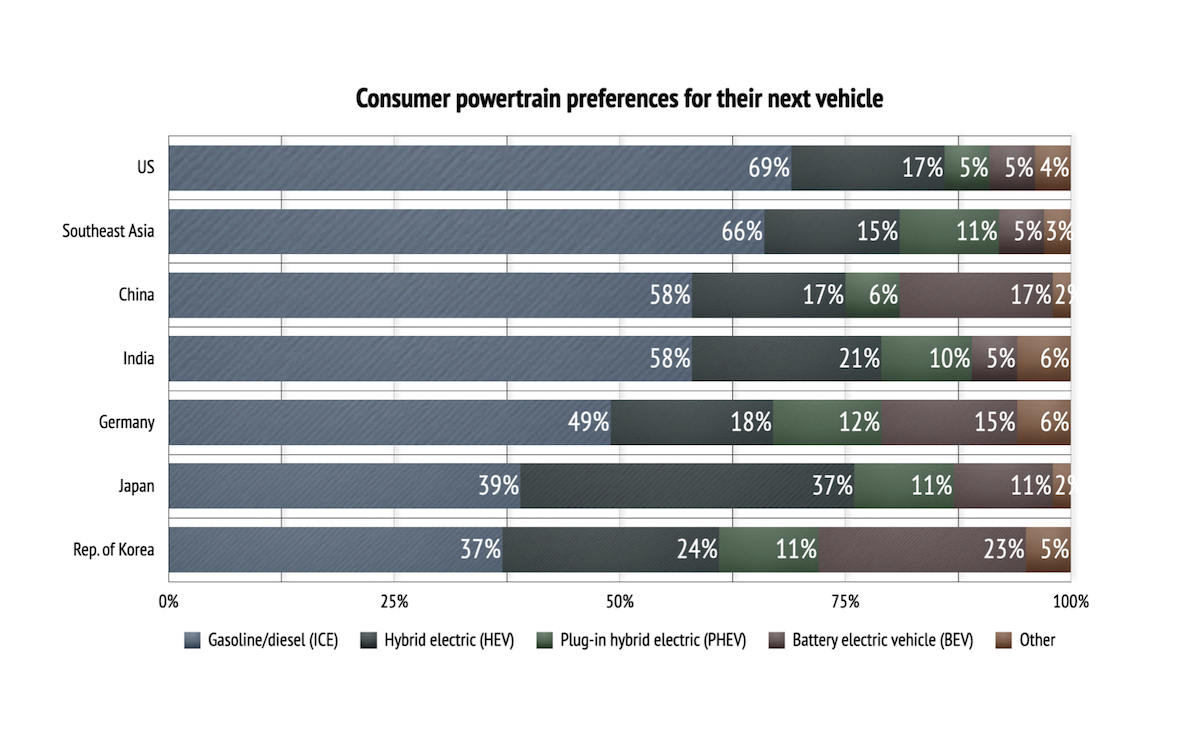

Interestingly, in the market research report published by world-famous Deloitte early this year that covered 26,000 people from 25 countries, it indicates the percentage of buying BEVs as their next car isn’t very high. Among the major countries, China has the most preference with 17%, and Germany and Japan have 15% and 12% respectively (Japanese prefers hybrid cars more), and the second largest market USA only have shockingly 5%. I have some findings after going thru the whole report…

- Range anxiety and the insufficiency of public charging infrastructure are the two main reasons for not buying BEVs at this moment.

- Higher prices are not the main reason of not buying BEVs, and they won’t change the thoughts even the prices of BEVS are as low as ICE cars.

- USA and China markets both are countries with vast land, but the demand of using BEVs is totally different. USA consumers need 800 km of range to travel at long distance (worrying about no charging ports in rural areas), and most of Chinese consumers need only about 400 km of range to travel at relatively short distance (long distance travels can be done by taking high speed rails that have complete coverage of the country).

- The availability of installing home charging ports is a critical hurdle of buying BEVs for Japanese consumers, but it isn’t a major problem for most of other countries; Even China can accept the absence of home charging ports as it has dense population and most of them lives in apartments in cities, and it means that the public charging infrastructure is quite convenient there (China is the least one to worry about the problem of public charging infrastructure.)

From these points mentioned above, we can understand that even though the battery technology nowadays may not be able to catch up the range and the convenience of refueling, it’s already sufficient for urban users. Moreover, regarding the low percentage of purchase consideration in this research report, BEVs sales could possibly reach 6.5 million units this year, and BEVs will be in most consumers shopping list as more all-new developed BEVs to be introduced by traditional carmakers and the charging infrastructures to be fully deployed in the next 3~5 years. To view from the perspective of Taiwan market at the same time, BEVs were sold 7,000 units last year, and the growth rate is 7.4% YOY, but Tesla took 80% share of this segment. This year, even the supply of Tesla models is unstable, it still had 71% accumulative growth rate in the first 5 months, and the trend is at about the same level as the global trend mentioned above. However, to view from other brands, the models being introduced to Taiwan and the supply are obviously insufficient, so consumers could not have more options. If Taiwan market can keep the sales pace of the first 5 month, then the annual BEV sales could reach 12,000 units, and the market share will be at the level of 2.8% (I predict that the annual car sales will be lower than 425,000 units). Apparently, figure like this is far away from the global level, which means… Domestic carmakers lacks the opportunity to manufacture BEVs authorized by OEMs, and imported car brands (distributors) didn’t take Taiwan as the highly-prioritized country to supply BEVs, and the progress of charging infrastructures deployment is slow. If the government hopes to follow the world in the progress of carbon neutrality, then the problem of automotive industry obviously is extremely urgent!