The Chinese government has gradually relaxed restrictions on certain companies testing and deploying driver assistance technology on public roads, driving up market demand for such features. While Tesla has already made its Autopilot system available locally, the more advanced Full Self-Driving (FSD) has yet to receive approval. Recently, Tesla CEO Elon Musk announced plans to bring FSD to China, strategically timing the announcement right after the company released its latest financial report. This move is expected to further intensify the competition in China’s driver assistance technology sector.

Tesla’s FSD technology relies on cameras and artificial intelligence, enabling automatic parking, lane changes, and traffic sign recognition. It can also decelerate or even stop before reaching an intersection, making it an upgraded version of the existing Autopilot system. Currently, Tesla only offers a limited beta version of FSD in China, and introducing the full version would require regulatory approval. As of now, FSD is only available in the U.S. and Canada.

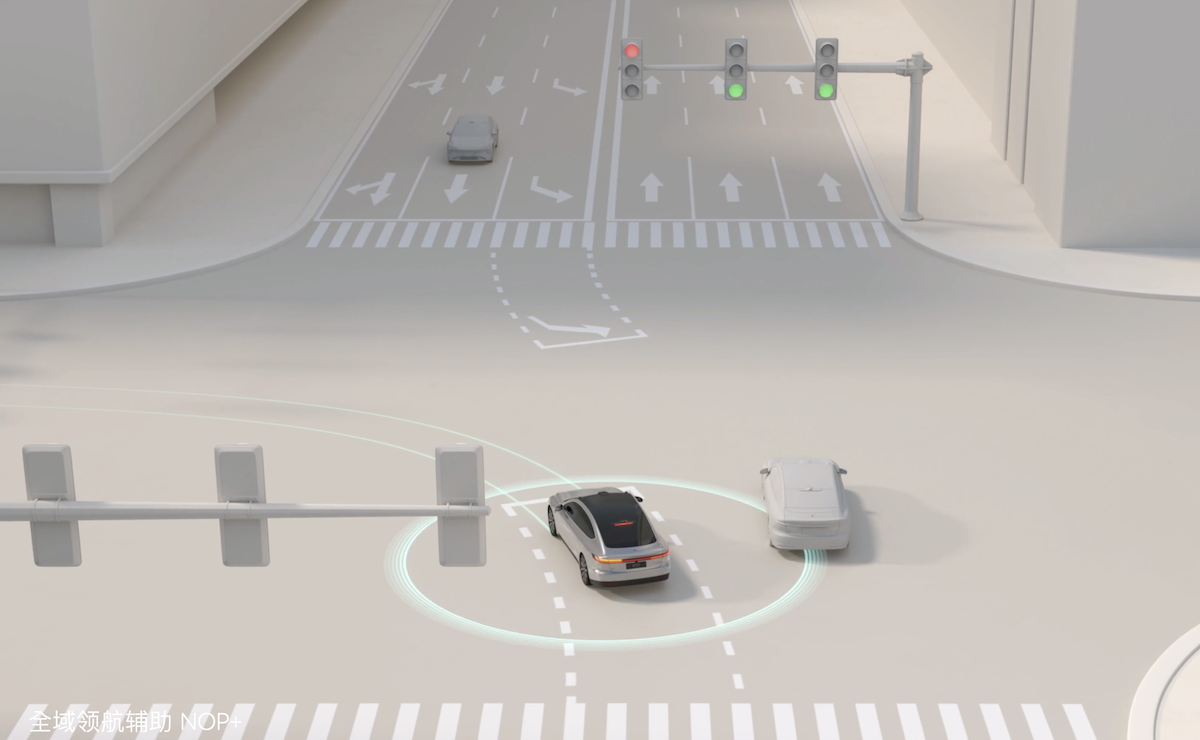

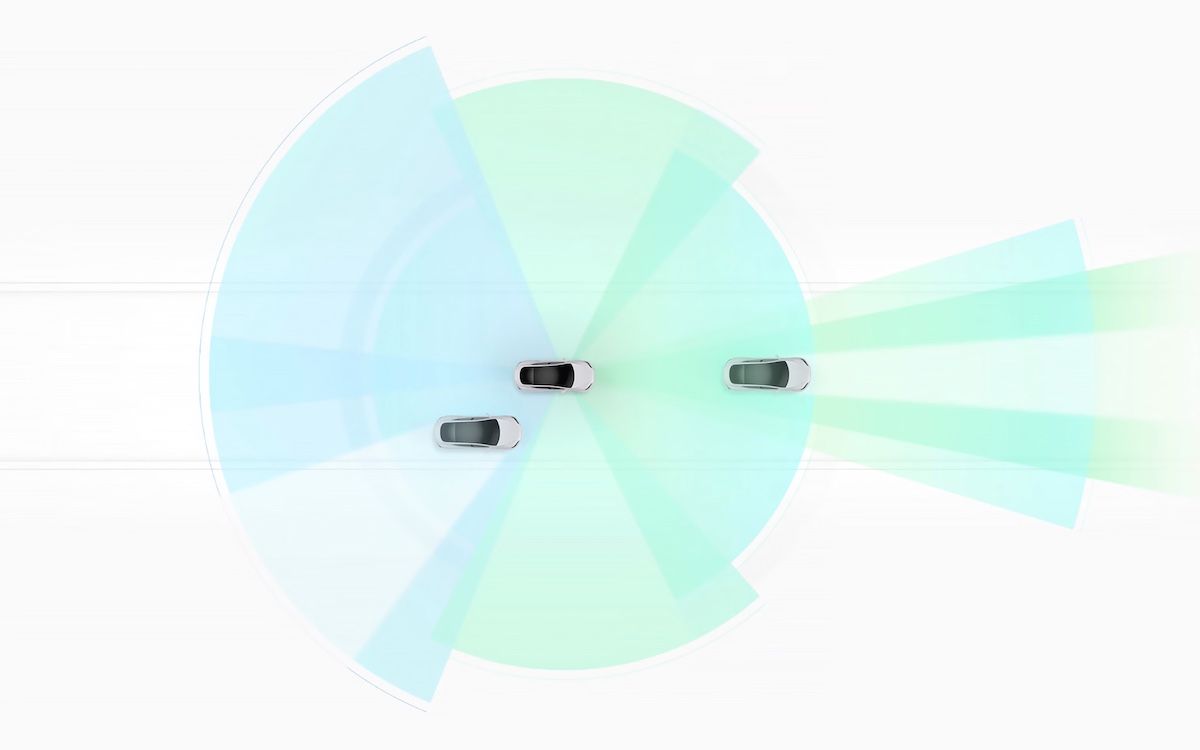

It is worth noting that although Tesla’s FSD boasts more advanced features than Autopilot, it is still classified as SAE Level 2 automation. Compared to NIO’s NIO Pilot, FSD lacks multiple detection technologies such as LiDAR, radar, and ultrasonic sensors. Additionally, its subscription cost is roughly double that of NIO’s system, which could pose a challenge when it officially launches in China.

Beyond technological competition, Tesla’s FSD also faces legal challenges. For instance, the California Department of Motor Vehicles (DMV) has accused Tesla of exaggerating its capabilities in advertising, prompting the company to respond accordingly. In China, Tesla-manufactured vehicles have already passed data security reviews, and once FSD gains approval, it will be ready to hit the roads and compete with emerging automakers. Looking ahead, if Tesla wants to maintain its market advantage in China, it must not only aggressively introduce new technology and adapt to local policies but also follow its U.S. strategy by rolling out software updates like FSD-S (Full Self-Driving Supervised) to continuously attract consumers.