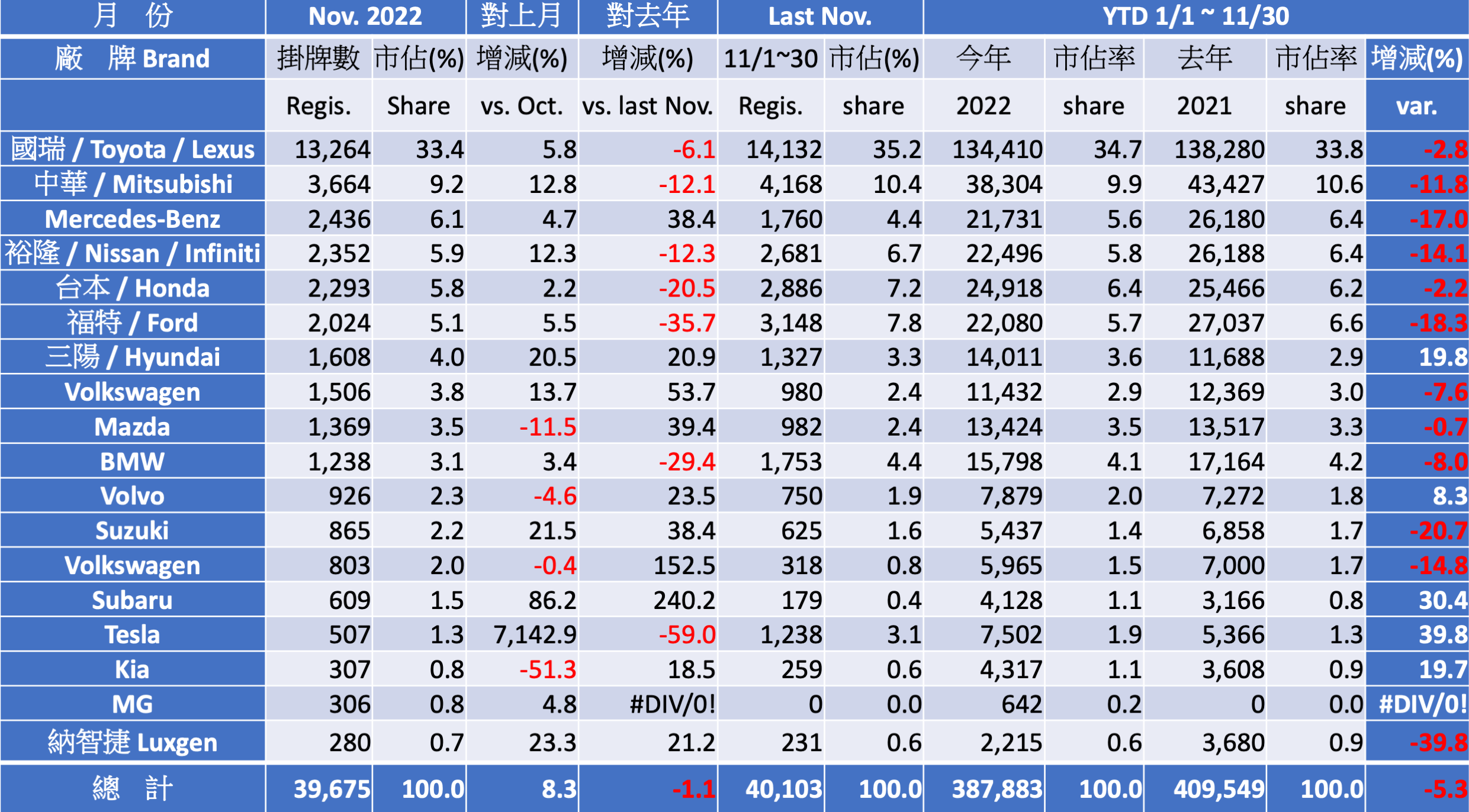

The car market in November has significantly increased by 8.3% compared with that of October, and the total registration number this month is 39,675 units, which is 1.1% lower YOY. In consideration of the influence of the election month, this performance is unexpectedly stunning. The accumulated registration number in the first 11 months this year is 387,883 units, which is closing the volume gap to 5.3% YOY. Many brands have certain growth of sales this month, which indicates the promotions before the end of this year had begun being enhanced, and I believed that the sales performance of next month won’t be under expectation. As for the global chip shortage issue, it’s just like my prediction last month that the situation will last until the 2nd half of next year, and the timing for Taiwan car market to be relieved from this issue will be later than other major markets, so it might be the year after. Now, it’s just one month away from the 2022 annual result, the annual performance of major brands can be concluded as below… Tesla has nearly 40% growth rate even in the situation of extremely unstable car supply; Besides, South Korean brands are undoubtedly the biggest winners… Hyundai and Kia have almost 20% growth over last year respectively; Especially Hyundai sold more than 14,000 units in the first 11 months, and I predicted that it will surpass 15,000 units for the whole year, as their market share would surpass Mazda and be getting close to BMW. Apart from these 3 best-performed brands, only Subaru and Volvo gain more sales this year. Other than these brands, other major brands perform worse than last year, while many of them suffer more than 10% drop YOY. In the upcoming year, as the key year of BEVs – 2025 is getting closer, the performance of every brand will begin changing significantly that it will depend on the product competitiveness and pricing strategy of the BEVs to be introduced. The annual car market size would be around 425,000~430,000 units, which is just like my estimate in the past few months.

Market share of brands:

The market share performance of each brand this month is still led by Toyota/Lexus (33.4%) and CMC Mitsubishi (9.2%) as the first and second place; If the MG (0.8%) is counted in, then CMC will have 10.0% share. The top two have stable performance that accounts almost 45% of the total annual car market. In addition, the 3rd to 6th positions of the YTD sales are Honda, Nissan, Mercedes-Benz, and Ford accordingly. Apart from Honda that is ahead with bigger margin, the other 3 brands are quite close with only a gap of 700 units so the final ranking might be reshuffled after the December sales result comes out. Among these brands, Nissan had announced to raise the prices in next January, and Ford had reduced the prices against the odds recently, so that the sales of these two brands will be going up in December. Compared with last month’s performance, Kia and Mazda both suffer the biggest gap. The main reason for Kia is that its delivery volume last month was relatively huge. Besides, the new face MG delivered 306 units this month, reaching the level of 300 units for 2 consecutive months.

Comparison between domestic cars and imported cars (excluding heavy duty trucks):

The sales ratio of domestic cars and imported cars is 53.9% vs. 46.1% this month, and YTD ratio is 55% vs. 45%. Domestic cars have relatively stable sales performance YOY since the beginning of this year, and also better than last year. However, in general, the issue of lack of supply influences more on imported cars brands this year.

Outstanding models:

There are 7 models that had more than 1,000 units of sales this month… Corolla Cross (3,930 units), RAV4 (1,453 units), CRV (1,439 units), Altis (1,434 units), Kicks (1,112 units), Focus (1,070 units), and Yaris (1,027 units). In the competition of light duty trucks, Toyota Town Ace had outperformed CMC Veryca (1,052 units vs. 684 units) for 3 consecutive months, and it’s a big win! In addition, the pre-sale of Town Ace Van is overwhelming, so that the competition with Veryca after it goes on sale is expected to be white-hot.

BEVs market:

The delivery of BEVs is totaling 1,052 units this month; Model 3 has been delivered by 461 units, and the iX has been delivered by 367 units, and some models started to have dozens of units delivered on a monthly basis. Tesla had delivered 7,502 units in the first 11 months this year, and as far as we know, the most competitive product Model Y will begin delivery in December. Tesla’s annual market share can surpass 2.0% for sure. The production lines of Tesla manufacturing plants around the globe had been adjusted to three-shift system recently, so I believed that the sales of Tesla in Taiwan will keep delivering record high performance next year. The annual share of BEVs out of the total market will be difficult to surpass 3% (or 13,000 units).