Market Overview:

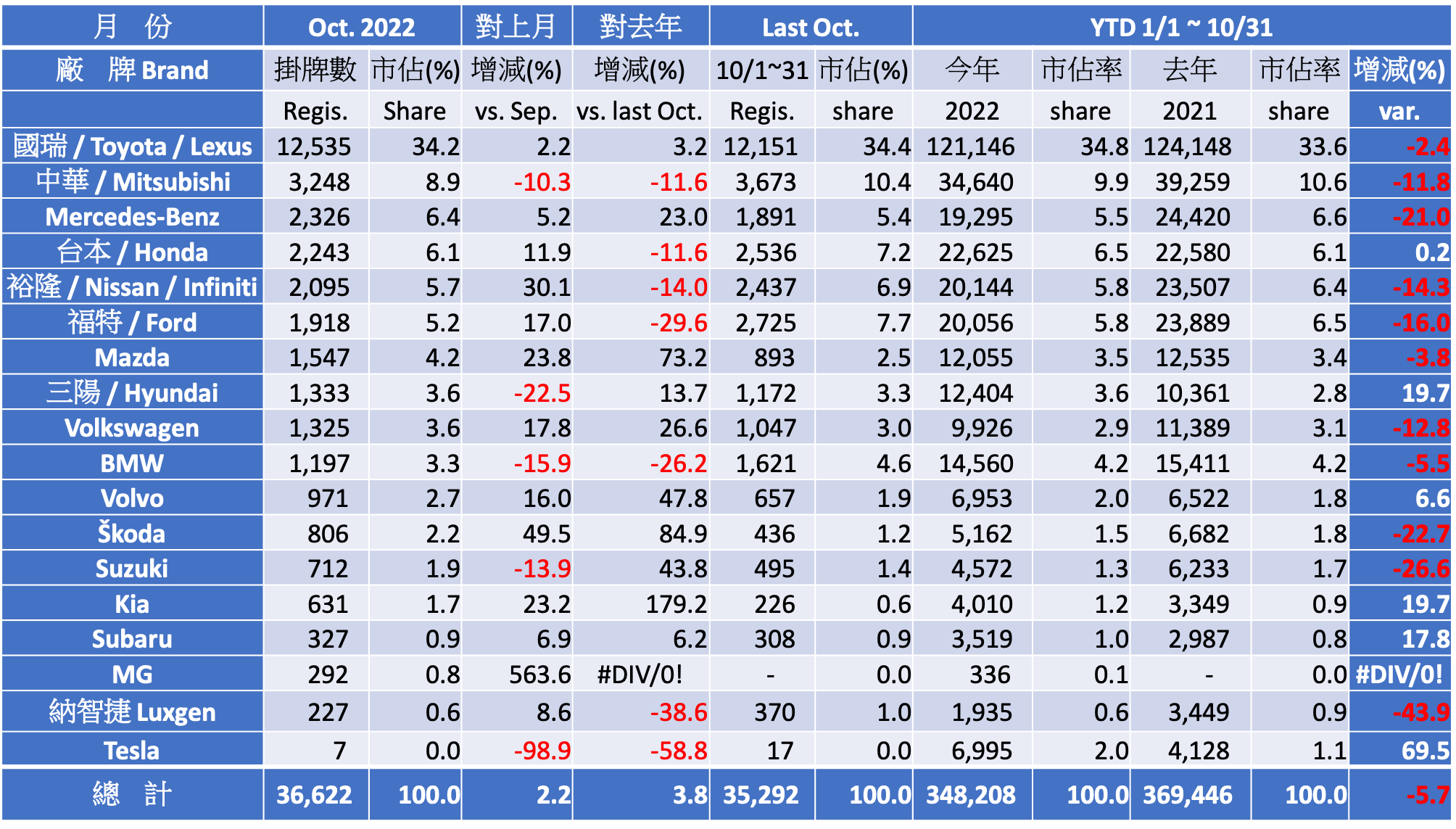

The car market in October has increased by 2.2% compared with September, and the total registration number this month is 36,622 units, which is 3.8% higher YOY and performing well. The accumulated registration number in the first 10 months this year is 348,208 units, which is closing the volume gap by 5.7% YOY, or just over 21,200 units. Many brands have big fluctuations of sales this month, which indicates the issue of unstable supply chain keep influencing the car delivery; The global chip shortage issue was originally predicted to be solved in Q4, but it looks like that it will last until next year, so the fluctuations of Taiwan car market at the moment will last to next year, or even the timing for solving this issue will be later than other markets with bigger scale. According to the figures from the first 10 months sales report, it’s enough to nail down the annual performance of each major brands… Apart from Tesla, which has almost 70% more sales than last year, there are 3 big winners this year… Hyundai, Kia, and Subaru; These 3 brands have at least 17% of growth than last year respectively, especially the two South Korean brands gain nearly 5% of market share in total, which shows the anti-Korean sentiment in the past has been terminated this year. In addition, many major brands have more than 10% of drop YOY, which means the performance vary largely among brands. That also implies there will be bigger changes happened in the market next year. The election will be held this month, and some brands had begun raising prices or giving discounts, which means the issues of USD appreciation, stress of annual target achievement/stock level, etc., are getting more severe before the end of this year. With the influences of multiple factors, the annual car market size would be around 425,000~430,000 units.

Market share of brands:

The market share performance of each brand this month is still led by Toyota/Lexus (32.7%) and CMC Mitsubishi (8.9%) as the first and second place; If the MG (0.8%) is counted in, then CMC will have 9.7% in total, but their performance is still lower than the level of 10% in the past. In addition, Mercedes-Benz, Honda, Nissan, and Ford ended up with close numbers. By viewing the accumulated registration number in the first 10 months this year, it will be Honda, Nissan, Ford, and Mercedes-Benz in order; The competition of 4th spot between Nissan and Ford is extraordinarily stiff. Nissan had just surpassed Ford this month, but the gap is less than 100 units currently, so the year-end winner is not confirmed yet. Compared with last month’s performance, Tesla and BMW have the biggest gap. Tesla encountered the bottleneck of supply again with only 7 cars delivered this month. Besides, the new face MG delivered 292 units this month and their sales in Q4 is worthy of attention.

Comparison between domestic cars and imported cars (excluding heavy duty trucks):

The sales ratio of domestic cars and imported cars is 53.5% vs. 46.5% this month, and YTD ratio is 55.2% vs. 44.8%. Domestic cars have relatively stable sales performance YOY since the beginning of this year, and also better than last year. However, in general, the issue of lack of supply influences more on imported cars brands this year, so that domestic cars are quite not easy to gain more than 55% sales ratio next year.

Outstanding models:

There are 7 models that had more than 1,000 units of sales this month… Corolla Cross (3,455 units), RAV4 (1,710 units), CRV (1,521 units), Altis (1,295 units), Kicks (1,154 units), Yaris (1,080 units), and Focus (1,033 units). This month is also the time that hot-selling models have the most outstanding performances in the past few months. In the competition of light duty trucks, Toyota Town Ace had outperformed CMC Veryca (956 units vs. 830 units) in 2 consecutive months. In addition, the pre-sale of Town Ace Van is overwhelming, so that the competition with Veryca after it goes on sale is expected to be white-hot.

BEVs market:

The delivery of BEVs is totaling only 421 units this month ; Kia EV6 has been delivered by 197 units, and Volvo XC40 P8 has been delivered by 171 units. All the others have very few of deliveries. Tesla had delivered nearly 7,000 units in the first 10 months this year, and their market share had reached 2.0%, which is outstanding. The production lines of Tesla manufacturing plants around the globe had been adjusted to three-shift system, so I believed that the sales of Tesla in Taiwan will keep delivering record high performance next year. The annual share of BEVs out of the total market will be difficult to surpass 3% (or 13,000 units).