Market Overview:

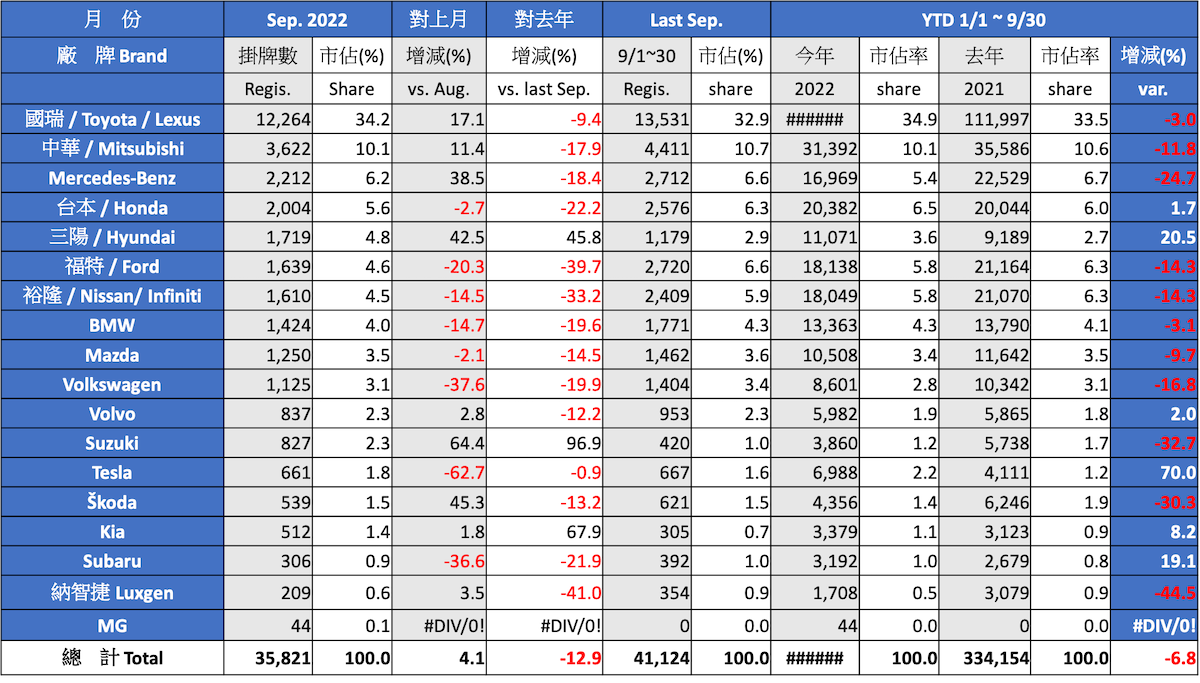

The car market in September has increased by 4.1% compared with August that is in the period of Ghost month, and the total registration number this month is 35,821 units, which is 12.9% lower YOY. Although the number is better than the past 4 months excluding July, but the accumulated registration number in the first 9 months this year is 311,586 units, which enlarged the volume drop by 6.8% YOY, and it converts to over 22,500 units. Overall, the delivery volume of imported car or domestic car brands are still affected by the unstable supply chain, which easily leads to at least 20% of fluctuation month by month that it will be unfair to evaluate the performance of a brand by monthly result. If we view from the performance in the past 3 seasons, then we might clarify some trends… Tesla is the biggest winner of this year undoubtedly, which has 70% more sales than last year, and Hyundai is another winner (20.5%). Apart from Subaru, Kia, Volvo, Honda that maintained the positive growth, the other major brands are dropping. In the situation that the year-end election day is approaching, and some brand had increased the car prices again without the lack of orders but short of supplies, even if the delivery volume of Q4 is exactly the same as Q4 last year, the annual volume will be landed at 427,000 units. Therefore, my prediction of the annual car market still remains at 425,000~430,000 units just like last month.

Market share of brands:

The market share performance of each brand this month is still led by Toyota/Lexus (34.2%) and CMC Mitsubishi (10.1%) as the first and second place, that they got away from the slump last month and back to the normal. In addition, the most impressing brand this month is Hyundai that had delivered 1,719 units, and the market share is 4.8%, which is ranked 5th and just behind Mercedes-Benz (3rd) and Honda (4th); Hyundai possibly broke its monthly sales record in Taiwan. Brands ranked behind it are Ford, Nissan, BMW in order. Compared with last month, the top 3 brands with the biggest drop of delivery volume are Tesla, Volkswagen, Subaru in order. Volkswagen just reached the record high monthly sales last month. To view from the accumulated market share in the first 9 months, Toyota/Lexus, CMC Mitsubishi, and Honda sit tight at the top three, and the competition for 4th place between Ford and Nissan is unexpectedly stiff by little margin of just under 100 units now. Tesla sits tight at 11th, and it might advance into top 10 next year. Besides, MG, the newly-launched brand, had begun delivery this month and its sales of Q4 is worthy of attention.

Comparison between domestic cars and imported cars (excluding heavy duty trucks):

The sales ratio of domestic cars and imported cars is 53% vs. 47% this month, and YTD ratio is 55.4% vs. 44.6%. Domestic cars have way better sales performance YOY since the beginning of this year, but the lack of the localization plan of BEVs is the long-term concern. If we only depend on the cars from self-owned brand – Luxgen, it will be far from sufficient supply.

Outstanding models:

There are just 3 models that had more than 1,000 units of sales this month… Corolla Cross (3,288 units), RAV4 (1,704 units), Altis (1,277 units). In the competition of light duty trucks, both Toyota Town Ace and CMC Veryca had more than 1,000 units of sales, and the Town Ace surpassed Veryca again after 2 months of falling behind (1,041 units vs. 1,010 units).

BEVs market:

The delivery of BEVs is totaling only 1,043 units this month, and Tesla Model 3 has been delivered 661 units. In addition, Kia EV6 has been delivered for 227 units, which is the best-performing BEV model in a single month by now. Certainly, if the supply is sufficient, I believed that EV6 sales performance won’t be just like this. As there is only one season left this year, I estimate that the annual share of BEVs out of the total market will be difficult to surpass 3% (or 13,000 units).