Since the commercialization of Sony products in 1991, lithium batteries have permeated people’s daily lives. A decade later, till 2000, lithium batteries have always been in the 3C (computer, communication, and consumer products) domain, and the Japanese battery industry has reached a whopping global market share of 93%. After the rise of the Korean battery industry, the Japanese counterpart’s market share declined to 43% in 2010, and the former industry rose to 39%. Afterward, the role of lithium batteries has turned into the hope of batteries for electric vehicles. Global development has been non-stop, drastically expanding the battlefield of battery industries. Starting in 2015, the Chinese battery industry’s technology in power batteries has been on a steep rise, achieving universal standards in key factors like energy density, lifespan, safety, etc. In 2019, CATL took the top position in the global market share. The top four spots of the latest Q1 market share data include CATL, LG Energy Solution, BYD, and Panasonic, reaching a combined market share of 72%, dominating the global power battery market. Batteries of BEV models we now see on the market are almost exclusively supplied by these four companies, save for some batteries manufactured by automakers artnering with one of these top four.

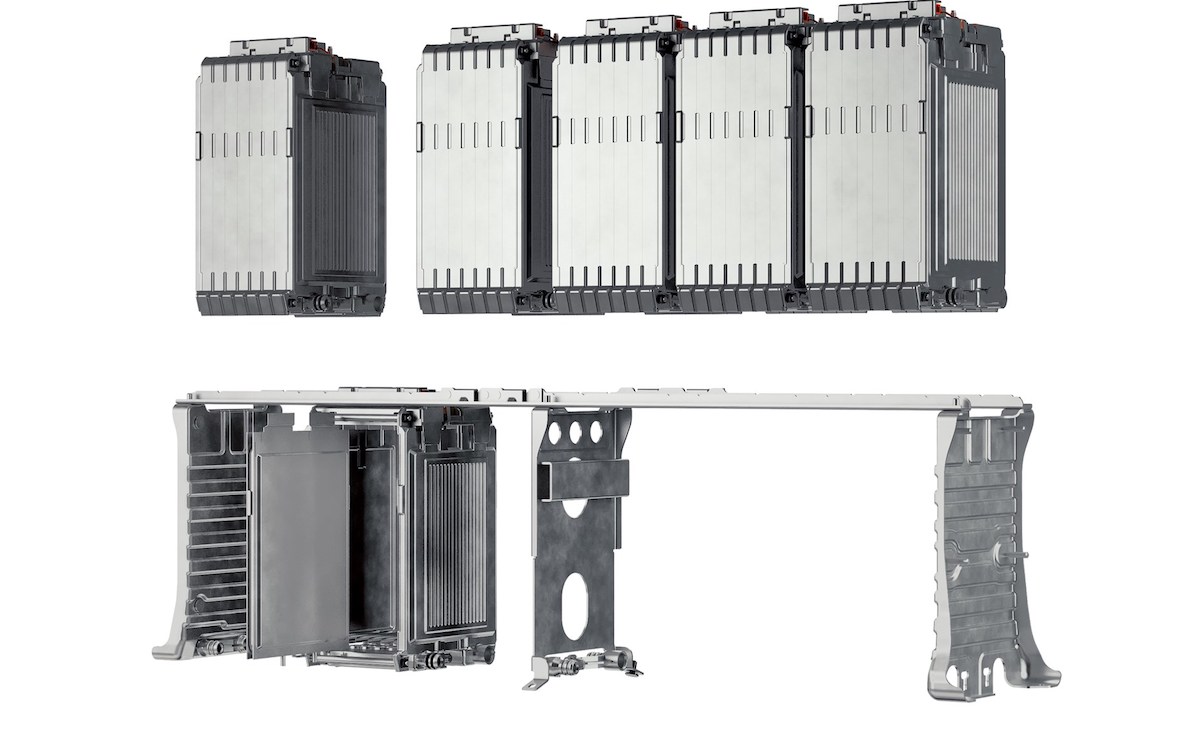

Viewing the technological advancements of lithium power batteries from another perspective, it goes as far back as LFP, lithium iron phosphate batteries… Around 2016, power battery technology gradually turned to newly-developed, high-performance lithium ternary batteries like NMC or NCA which eventually surpassed LFP as mainstream products in the market. As one would expect, the popularity of battery models then lied solely upon the biggest customer in the world - Tesla. Subsequently, due to multiple breakthroughs in battery technology and the increasingly rare and costly raw materials for lithium ternary batteries, the cheap and durable LFP gained the market’s favor last year. Besides, the global electric vehicle industry had exceptional growth last year, especially favored budget electric car models in the Chinese market that greatly utilize LFP. As for premium brands like Mercedes and Tesla, they had also locked on the more stable-supplied LFP to pair their models. Has LFP already achieved a dominant victory? No! Not only is the battery market tyrant (scoring a global market share over 1/3) CATL’s 811 lithium ternary battery has reached an exquisite balance in performance and cost, the cost-effectiveness of lithium ternary batteries benefitted from CATL’s module-less CTP design and 90% efficiency battery recycling business (to reduce the procuring cost of raw materials) has pushed the commercialization level of lithium batteries to a new height. As for the newly-announced CTP 3.0 battery “Qilin,” CATL claims to have a few ground-breaking technologies…

- 72% volume utilization efficiency.

- Up to 255 Wh/kg system energy density for 811 ternary lithium battery type (higher than Tesla’s 4680, marking 217).

- 160 Wh/kg for the LFP battery type (higher than BYD’s blade battery, marking 140).

- Completing 10%~80% fast-charging process within 10 minutes (not considering specs and costs of charging posts and battery capacities.)

Additionally, CATL’s cell-to-chassis (CTC) technology aims to be commercialized by 2025 with an improved volume utilization efficiency. Of course, being the second and third place in market share, LG Energy Solution and BYD are not playing around. So far, LG Energy Solution, with its products employed by carmakers worldwide, has been dominating the market (excluding the Chinese market). However, since Q2, BYD (previously supplying batteries mainly to itself) has been speeding up its external supply, and so far, it has already caught up with LG. As Tesla plans to use BYD’s blade battery, the takeover of LG’s throne is certain.

The lithium battery technology as a whole is about to reach its peak. What comes after are contests of cost and supply stability; the cost of lithium batteries will drastically decrease, segmenting their market with higher performance solid-state batteries that will be commercialized in four to five years. Even though there would be more cutting-edge battery technologies afterward, the already matured and stable lithium batteries - in terms of technology and cost - can still hold a place in the market. The development of battery technologies will never stop until the commercialization of batteries with 500 Wh/kg energy density that can fulfill the needs of ICE car owners.