Market Overview:

Half of this year has passed, and after months of poor performances successively, the registration of this month began to stop declining then start to grow, and the total registration is 32,633 units, which has 5.5% or 16.7% of growth compared with last month and YOY. The accumulated registration in first 6 months this year is 203,158 units, which has dropped 8.4% YOY that is lessening the gap with the performance last year. Some of the imported brands has significant increase compared with that of May, which is obviously due to supply issue that postponed the car delivery to this month. Overall, the annual prediction of this year is still mostly influenced by the supply chain, and it’s unlikely to reach the level of 450,000 units last year. Even though some carmakers still be optimistic about the market demand this year that predicts the annual registration will be 460,000 units, but in the situation that the global issue including chip shortage etc. haven’t been solved, it’s already difficult to surpass 228,000 units for the 2H last year, not to mention the gap of 18,000 units that has fallen behind in 1H this year, plus to sell 10,000 units more?! If the performance like this really happened, then it will break the record of best 2H sales in Taiwan market for the past 20 years. My observation of the market in 2H is conversative, especially the trend of leading indicators like the stock market, even the coming July, which is usually the hot-selling season, couldn’t be predicted too optimistically. I will keep the prediction of annual market as that of last month… 425,000 units.

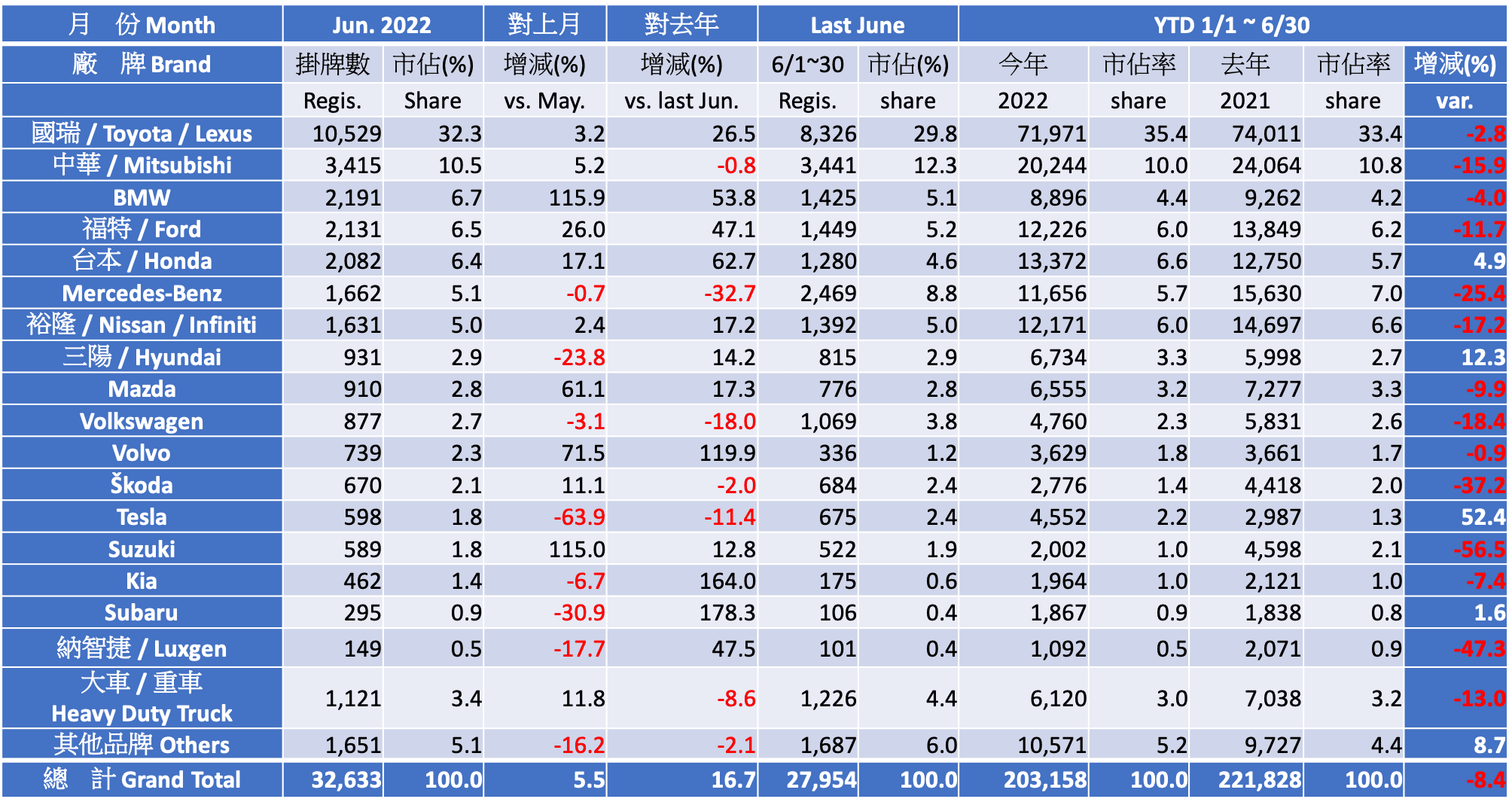

Market share of brands:

The market share performance of each brand is still Toyota/Lexus (32.3%) and CMC Mitsubishi (10.5%) as the first and second place. There is a stiff competition between Honda, Ford, Mercedes-Benz, Nissan in 3rd to 6th place that each of them has 5%~6% share respectively. Besides, in this month, BMW has 115.9% of growth compared with last month that takes the 3rd place, and surpassed Toyota in the imported cars market to take the 1st place. But to view from the accumulated registrations in 1H, the ranking of 3rd to 6th is still Honda, Ford, Nissan, and Mercedes; BMW, Mazda, Hyundai are behind them. As for Tesla, which has always unstable supply, delivered 598 units this month, and the market share in 1H is 2.2%, and the growth YOY is 52.4%, which has outperformed every major brands. On the other hand, Hyundai and Honda has significant growth in 1H that is not easy among the time of unstable supplies.

Comparison between domestic cars and imported cars (excluding heavy duty trucks):

The sales ratio of domestic cars and imported cars is 54% vs. 46% this month, and YTD ratio is 55.5% vs. 44.5%. Domestic cars have better sales YOY, but imported cars have abundant orders waiting for delivery, if the supply is smooth, then the situation in 2H is likely to invert that the ratio of imported cars will begin increasing, and it will be like my prediction last month that when the end of Q3 comes, the accumulated share of domestic cars will drop to under 55%.

Outstanding models:

The most outstanding model isn’t from Toyota this month, but the Ford Focus that beats the long-standing Altis (1,235 units vs. 1,106 units). On the other hand, Corolla Cross’s 3,066 units and RAV4’s 987 units are still two trumps of Toyota. In addition, Honda CR-V has an outstanding performance of 1,116 units. In the competition of light duty trucks, Toyota Town Ace’s 922 units has surpassed CMC Veryca’s 840 units this month.

BEVs market:

The registration of BEVs is only 859 units this month, and the reason is simple… Tesla’s lack of supply. Even so, Tesla still have grabbed almost 70% of market share in this segment this month. Tesla has delivered 4,552 units accumulated in 1H, which is only a 1,069 units gap between 5,621 units FY last year. Other brands have 261 units in total, even if carmakers have sufficient orders but the supply is abnormally insufficient, which shows that the BEVs market in Taiwan are not highly prioritized in OEMs production pipeline.